A Poor Future for Designers

How far do you look into the future at your financial success? Do you live day-by-day? Do you budget per week or month? Or maybe quarterly or yearly? If you’re like most people (myself included), you probably spend money on what you need, check your account balance to make sure there are an estimated amount of enough funds, rinse, and repeat.

There’s nothing inherently wrong with that approach to finance it certainly works well enough, but I want to share with you where and why I’ve been focusing on my financial intelligence (or financial IQ) recently. This may open your eyes to some of the same things my eyes have been opened to over the past few months.

As a disclaimer, I don’t have a degree in finance and am not an expert. I’m a designer. I’ve read a handful of books, and I’m just sharing what I’ve learned and my insights.

The Far Off Future

I’m 26 but know that now is the time to really set financial goals for retirement. My previous employer offered a 401k plan and matched contributions. Basically all that means is that my employer had a retirement plan of investments in stocks and whatever money I put in, they would put in the same amount. (…And just to clear things up, 401k is not $401,000. It is named after the tax code that governs them.) The stocks were pre-picked by my employer so all I really did was put money in and hope for the best. My retirement success was in the complete control of my employer. If it’s the same in your case, this may be a sigh of relief for you, or if you don’t entirely trust your employer, it may be something that makes you sweat a little. At the end of the day, stocks are risky, and in theory you could lose it all at any moment (like a lot of people saw happen to them in 2008). Most financial advisors will tell you to diversify your portfolio to protect against risk.

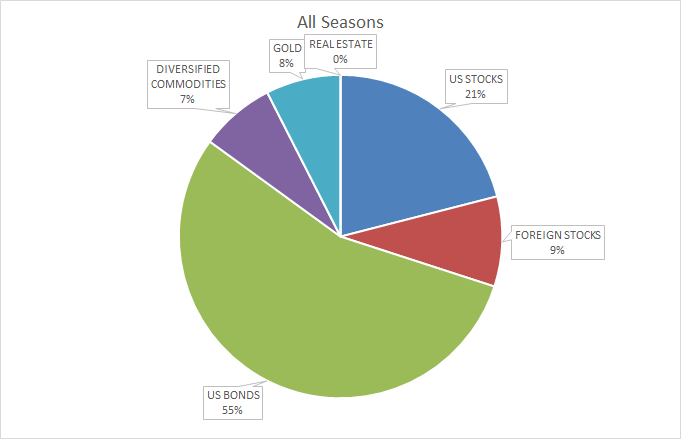

If you’re interested in learning how to create a diverse portfolio from one of the most successful investors to walk the earth, Tony Robbins unveils Ray Dalio’s All-Weather (or All-Seasons) approach to investing in his book Money: Master the Game. While Tony urges the importance of reading his entire book to get into the right mindset, (a daunting task for a 688 page financial book) I’m going to give you a sneak peak at the break-down.

If you want to learn more about the all-seasons portfolio, Yahoo has a post on about the portfolio which is an excerpt from the book itself. I listened to the audiobook over the course of about a week and a half. Some stuff went over my head, but there’s a lot of good take-aways if you can stick with it.

But back to your company 401k…

If your employer is choosing your stocks for you, your diversity is dependent upon the stocks they pick, and stocks as a general category. If you lost all of your money from investments would you rather it be because of your error or your employers?

I am by no means suggesting that you shouldn’t invest money in your company’s 401(k) plan if they offer it. On the contrary, if they offer matching, it’s the only way you have a chance at getting the money they rightfully should be paying you. In his book Increase Your Financial IQ, Robert Kyosaki speaks on this point in conjunction with taxes:

In America, even low-income wage earners pay a high percentage in taxes. Workers approximately pay a 15 percent tax for Social Security, and they also pay federal, state, and local taxes. Now, I can hear some people saying that Social Security is not a 15 percent tax. They think it is more like 7.4 percent, and that your employer pays the other 7.4 percent. That may be true, but my way of looking at the combined 15 percent is that it is my money. If my employer did not pay it to the government my employer should pay it to me.

The same is true with employees who think their employer matches their 401(k) retirement money. That money, paid by the employer to an investment banker for safekeeping, is still your money.

By-and-large, gone are the days of pension plans that secure employees with a fixed income upon retirement. They’re simply too expensive to uphold for employers. But that means that you’re faced with the choice to a) let your employer gamble your money for you b) gamble your own money c) avoid the gamble all-together.

I don’t tend to be a gambling kind of fellow, so I lean towards option c), but that probably doesn’t mean what you think it does. I do invest through etrade, but I don’t put all my eggs in one basket. I actually prefer to make money where I have much more control, and I’ll show you how I’m doing just that.

Assets vs. Liabilities

Most people spend their time acquiring liabilities instead of assets. As Robert Kyosaki defines the two in his book, Rich Dad Poor Dad,

An asset is something that puts money in your pocket.

A liability is something that takes money out of your pocket.

Take a second and think about the things you own, are they assets or are they liabilities?

If you’re like me, most of the things you spend your money on are liabilities (your car, your house, your gym membership, your daily coffee, etc.). The key a high financial IQ is knowing how to find assets and acquire them. I use mint to automatically divide my spending into categories so I can quickly see how much money is going into assets and liabilities.

As I’ve been spending time really thinking about how to acquire assets, I realize more and more that it’s simply a matter of noticing liabilities and trying to turn them into assets.

For example… I have a long commute so the bills that go along with my car are pretty considerable. It’s VERY safe to say that my car is a liability. But maybe it doesn’t have to be. A quick google search on, “how to make money on your commute” gives me a news article that shows just that. There are a bunch of services like Sidecar, Lyft, or Uber I could join to get paid to drive other commuters with similar routes. I enjoy the alone time in my car, so maybe I want to look more into something like Barnacle where I can deliver packages.

But, let’s get back to those stocks. As long as your stocks are doing well, they’re assets. When they tank, they become liabilities. That’s a game you might be willing to play, but it’s not the only way to gain a potential asset. Like I said, I like to avoid the gamble.

My coworker scoffed at the income that this site generates when I started advertising in the summer of last year. At the time, this site was generating just a few cents a day. “$.01?”, he laughed, “are you going to retire soon?”. Months went by, and I kept at it, I now average $.50 per day, which certainly still isn’t enough to retire from. But here’s the thing, he started using Acorns to invest in stocks (by the way, they pick the stocks for you just like an employer does for that 401k). He watched his contributions be affected daily through the roller-coaster of stock-market (a practice no investor should take on). Over the course of about 3 weeks he saw a $3.00 gain on his money. Then one bad day at the market and his earnings were gone in addition to some of his original investment. He was sitting at -$2.50 (certainly a liability at this point) He decided he wanted to pull all of his money out. The result? A ton of time managing and worrying about money with (less than) no return.

Even if you put money into your savings account, (the best savings I’ve seen will get you a .08% return per month), you’re not going to be making a ton of money. If I’m averaging $0.50 a day for 30 days through ads on my website, that means I’m netting around $15.00 per month. After hosting fees, that’s around $9.00 or so per month. To get $9.00 a month with the savings account I can find you’d need $11,250 in your account. My measly advertising doesn’t sound so bad after all does it?

Of course, having your own website isn’t the only asset you can have. As a designer there are tons of ways to make extra cash, here are some that come to mind:

Assets for Designers

Start your own website or blog

- Bluehost – Bluehost makes it super easy to get setup and start running your website in minutes. I have a walk-through where I share how to do this in less than 5 minutes. A website is a great asset to have because the only limitation to the amount of money you can make is your creativity. Chew on that for a second.

Invest in Photoshop or some other photo editing software

- Fiverr – Everything on fiverr starts at $5. You can offer services there and make a quick $5 bucks. Pro tip: I know $5 doesn’t seem like a lot, but if you have photoshop, you can setup actions to automate a design process. This can be a great way to turn your design skills into a bit of a manufacturing plant.

- Skreened – You can charge a commission and sell t-shirt designs on here. There are a ton just like this, but this is the one I’ve used for a long time. I like it the best.

Buy a 3d Printer

- Etsy – If you combine sketchup skills with 3d printing you can make virtually anything. Create an etsy store and you can sell anything.

Destination: Retirement

No matter your age, you’ve probably heard someone mention before that they “can’t wait for retirement”. Heck, maybe you’ve even felt that way yourself. I recently read Tim Ferris’ 4 hour work week. (It’s a great (best-selling) book, I highly recommend the whole read particularly if you’re interested in productivity, traveling the world, or interested in working from home.) In the book, Tim talks about taking mini-retirements instead of saving it all for the end. He gives three solid reasons that retirement as a destination is flawed,

a. It is predicated on the assumption that you dislike what you are doing during the most physically capable years of your life. This is a nonstarter—nothing can justify that sacrifice.

b. Most people will never be able to retire and maintain even a hotdogs-for-dinner standard of living. Even one million is chump change in a world where traditional retirement could span 30 years and inflation lowers your purchasing power 2-4% per year. The math doesn’t work.4 The golden years become lower-middle-class life revisited. That’s a bittersweet ending.

c. If the math does work, it means that you are one ambitious, hardworking machine. If that’s the case, guess what? One week into retirement, you’ll be so damn bored that you’ll want to stick bicycle spokes in your eyes. You’ll probably opt to look for a new job or start another company. Kinda defeats the purpose of waiting, doesn’t it?

This really got me thinking. Why save it all for the end?

Of course I don’t mean spend everything you earn. It’s important to have a savings, build up your nest egg, and be a financial steward for your future, but that doesn’t have to mean when you’re old and gray. You can save up for an awesome mini-retirement every couple of years. Live it up, enjoy life!

How are you preparing for you financial future? Leave a comment below!

Ty, What’s your website?

Ty, I don’t know how I missed this!

This is some of the best advice anyone has ever given to me! (and I’m not just saying that because I like you [even though I do]).

Thanks so much for sharing.

I liked your comment about being bored! It’s funny, but true!

OH, I like the idea of residual income. Since I have a web-site maybe I will advertise. How 21st century.

Hey Tony, observations from an older architect (55). First I read this piece by originally getting an update from Drafting Hub which came from the Linked in SketchUp user group. I think that’s pretty cool too.

I think you are basically right on the money (ha!) A friend of mine and I both ‘retired’ from successful architectural careers in big into retail big-box. Boy were we lucky. Kinda like the specialists in health-care projects that never seem to stop.

We didn’t retire.

We are still picking and choosing projects that spark interest in what we have always been interested in – Problem Solving through Good Design.

The most important part of what you are dealing with is really ‘Delayed Gratification’

You are right that saving versus spending is a conundrum. Like living and dying. The trap is to believe that credit and borrowing are a safe means to get what you want NOW!

I became a father at your age, and immediately wanted my child to go to college some day (delayed gratification) and started saving a percentage for that goal by buying savings bonds ins small denominations every paycheck.

When employers offered 401K plans I utilized them for bonuses and salary increases, but not additional contributions.

Two years ago, I looked at the DIVERSITY of things that I had made small investments in when I had the choice between ‘saving’ or buying a 55 inch tv to replace my 32 inch tv. I was able to retire (sort of).

I need to keep busy. Travel and hobbies do not fill 40 hours a week for 35 years.

I don’t need to be Donald Trump, heck he’s so bored he’s running for president.

Curb your rampant materialism, you don’t need everything today, or you’ll be bored tomorrow. Sometimes it is good to wait a long time to get something, because once you have it, you will want something else. Accept the fact that if you like what you do to make money, you are better off than someone who doesn’t like their career even though they make big money.

Good luck on the ARE. Having your stamp gives you a lot of freedom: you can be your own boss even in your 80’s like Warren Buffet.

Yeah, I use mint too. It’s nice to be able to periodically check back and not have to be on top of things ALL the time.

I totally just signed up for Mint. I would spend a half a day every couple months in college and the first few years out inputting all my expenses etc. into an excel spreadsheet to keep track of my budget…. I eventually just gave it up because of how much time it took me! This seems great so far!

Great news Cesar! If you run into any stags feel free to reach out!

Thanks Tony – came to your site via search on “sketchup …” topics and found this even more interesting post. I also viewed your “start your own website …” post and video. Thanks for the inspiration – I’ll be taking that plunge soon.